Find Out Now, What Should You Do For Fast Cryotherapy Units Market?

Research Nester released a report titled "Cryotherapy Units Market: Global Demand Analysis & Opportunity Outlook 2027"which delivers detailed overview of the global cryotherapy units market in terms of market segmentation by therapy, by area of application, by application and by region.

Further, for the in-depth analysis, the report encompasses the industry growth drivers, restraints, supply and demand risk, market attractiveness, BPS analysis and Porter's five force model.

A cryotherapy unit is a medical device using for cryotherapy for targeting either partial of whole body for the treatment of certain disorders as well as for pain management. The market for cryotherapy units is anticipated to grow with a CAGR of 10.1% during the forecast period, i.e., 2019-2027.

The market is segmented by therapy, by area of application, by application and by region. On the basis of therapy, the market is segmented into liquid nitrogen therapy, dry ice therapy and electric therapy, out of which, the liquid nitrogen therapy segment is estimated to hold the largest share in the cryotherapy units market. Liquid nitrogen therapy can be applied to the affected area easily and provides maximum efficiency on the back of which this segment is predicted to grow.

Get Exclusive Sample Report Copy Of This Report @ https://www.researchnester.com/sample-request-2226

Geographically, the market is segmented into five major regions including North America, Europe, Asia Pacific, Latin America and Middle East & Africa region. The market in North America is anticipated to hold the largest share in cryotherapy units market as a result of growing technological advancements in the healthcare industry in the region which give rise to improved healthcare facilities. The market in Asia Pacific region is predicted to grow at the highest rate over the forecast period on account of rising awareness among people about the availability of various cancer treatment methods.

Higher Prevalence Of Cancer To Raise The Demand For Cryotherapy

According to the World Health Organization, it was reported that in 2018, around 18.1 million new cases of cancer were detected and 9.6 million deaths due to cancer were estimated.

The growing cases of cancer is anticipated to become a major growth factor for the cryotherapy units market. Introduction of cryotherapy as an advanced form of cancer treatment method further drives the market growth. However, the lower adoption rates of this therapy, especially by people living in developing and under-developed regions is predicted to limit the market growth over the forecast period.

This report also provides the existing competitive scenario of some of the key players of the global cryotherapy units market which includes company profiling of JUKA, Impact Cryotherapy, MECOTEC GmbH, Zimmer MedizinSysteme GmbH, Cryomed, METRUM CRYOFLEX, Kriosystem - Care Sp. z o.o., TITAN CRYO, US Cryotherapy and �CRYO.

Get More Info @ https://www.researchnester.com/reports/cryotherapy-units-market/2226

The profiling enfolds key information of the companies which encompasses business overview, products and services, key financials and recent news and developments. On the whole, the report depicts detailed overview of the global cryotherapy units market that will help industry consultants, equipment manufacturers, existing players searching for expansion opportunities, new players searching possibilities and other stakeholders to align their market centric strategies according to the ongoing and expected trends in the future.

Contact for more Info:

AJ Daniel

Email: sales@researchnester.com

U.S. Phone: +1 646 586 9123

U.K. Phone: +44 203 608 5919

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Patrick Barkey: Finding good workers and finding the best solution for Montana

Attend almost any gathering of business people and the topic is sure to come up: finding good workers. After more than a decade of economic growth that has featured strong hiring and steadily falling unemployment rates, labor markets across the country and certainly across Montana are tight.

For some businesses, the trickle of suitable workers for their openings has shrunk to the point where they are questioning how they can continue to fill orders, let alone capitalize on new opportunities.

The data agree with this assessment — at least to a point. The Montana unemployment rate has been below 4% for more than two years, with jobless rates for fast-growing places like Gallatin County down to an incredible 1.9%. At the height of the recession, there were more than seven unemployed workers for every job opening in the western region of the United States — now there are fewer than one.

As economic problems go, you might say this is a good one to have — too many jobs, shall we say. But it is a problem nonetheless, and some solutions (e.g., offshoring, turning down business) are worse than others for the economy. Understanding how and why it has come about is critical to crafting strategies and solutions that grow the economic pie. That’s why we’ve made “Finding Good Workers” a theme of our half-day economic outlook programs we’re taking around the state beginning late January.

What can businesses do right now to address this?

Of course they can boost salaries. What would you expect an economist to say? Nationally there is some evidence of this, with faster growth in hourly wages. In Montana, the evidence is less clear — wage growth is more erratic, but showing faster growth in the last year. Higher wages are not a zero sum solution, as they pull more people into the labor force.

That solution is not available for many employers who lack the ability to pass on cost increases to their customers. That’s why they’re doing other things, like reorganizing roles in the workplace, redefining some jobs to fill the gaps created by unfilled vacancies. Or hiring less qualified workers, investing in training to bring them to the required level of skill, even at the risk of losing their investment when they take jobs elsewhere. Pursuing automation as a way to reduce staffing requirements, or outsourcing or offshoring tasks once performed in-house are other options.

The “solution” of turning down work that is offered, or even cutting back on current operations, is another kind of adjustment that is clearly on the menu of choices as well. And some Montana employers have doubtless gone down this path.

Is it time for fresh thinking on recruiting and retaining good workers? Nothing fuels innovation like scarcity. Some solutions to finding good workers for openings are hiding in plain sight, although making them work might be more than an individual company can take on. Perhaps policy could help.

×

You have run out of free articles. You can support our newsroom by joining at our lowest rate!

Loading&hellp;

Sorry, your subscription does not include this content.

Please call 866-839-6397 to upgrade your subscription.

Some of these ideas are different. Some might even be considered dead on arrival. Yet they address a real problem and could offer some relief. They include:

• Tapping the teenage labor force. Teenager participation rates are down almost 20 percentage points from 2000, when more than half of those ages 16-19 worked;

• Reconsidering drug testing. With recreational cannabis gaining public acceptance, is it time to revise our thinking on drug testing as an absolute requirement for employment?

• Convicts and ex-convicts — with 4% of the world’s population, the U.S. has 22% of the world’s prisoners. Is this an opportunity?

Other ideas are perhaps less controversial, yet no easier to implement. The most straightforward is devising better tools and policies to accommodate fuller participation of young women in the workforce. While narrower than some other countries, in the United States women have participation rates that are 10 percentage points lower than men. And they work fewer hours. Child care is ferociously expensive when it is available, which in many places it is not.

It is also a time for employers of all kinds, but especially for those requiring skilled trades employees, to start reaching out to potential workers at a younger age. A recent survey reported that a large fraction of high school students would not consider a career in construction even for a six-figure salary. That’s a daunting challenge that should spur employers to action to dispel perceptions that may pose a dire threat to their pipeline of new workers.

And then there are older workers. They are already more numerous in the workplace, with a quarter of the workforce projected to be ages 55 and older in 2024, compared to just 12% in 1994. Abolishing mandatory retirement ages and pushing up the Social Security and Medicare ages would strengthen the incentive to work, certainly. But only if employers want them — and there is evidence that older workers’ higher costs and relatively lower motivation to learn new things makes them less attractive. Addressing these challenges wouldn’t be easy, but there are clearly rewards to doing so.

Patrick M. Barkey is director of the Bureau of Business and Economic Research at the University of Montana. For more information on the Bureau’s economic outlook programs, visit www.EconomicOutlookSeminar.com.

This column appears in Missoula Business, a new publication that reports on emerging trends and goes beyond the numbers to look at the insights and drive of the people leading Missoula forward. Find the first issue inserted in the Sunday, Jan. 26, print Missoulian and soon in the e-edition, and read the stories on Missoulian.com.

Subscribe to our Daily Headlines newsletter

Determining The Income Investing Game Plan For 2020

The differences in the start of 2020 and the start of 2019 couldn't be more stark. When we began 2019, credit spreads were much wider at nearly 5.5%. That means the average high yield (read non-investment grade bond) traded 5.5% higher in yield compared to the same maturity treasury bond. Over the last 10 years, it has only done that twice - in late 2011 and again during the high yield bond swoon of 2015-2016.

Fast forward 12 months and high yield spreads are about 2 points lower - +3.62% - not far from the lowest levels of the post-recession period. When you buy a high yield bond, you can earn a return from two sources: the yield/coupon and capital appreciation. The yield is simple - it is the interest income generated from the stated coupon. The capital appreciation piece is different. It comes from the price of the bond increasing. That can be due to the prospects of the underlying company having improved (maybe a credit upgrade) or spreads decreased.

Without the ability of further spread compression, income investors in the bond market have become coupon clippers. That means the ability to produce strong returns in both the equity and fixed-income markets is probably over, even if rates decline more. In the last year, we can see how strongly areas of the fixed-income markets have done:

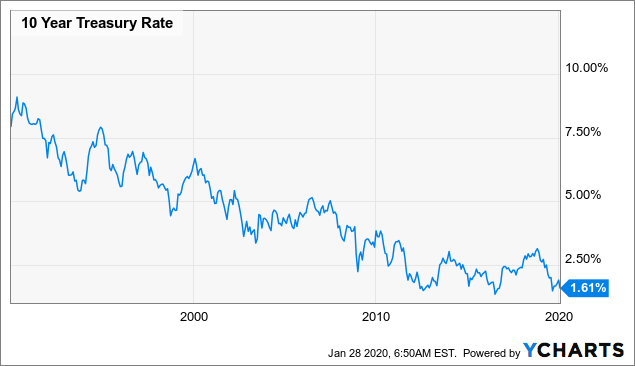

As the bull market enters its 11th year, a growing vocal chorus of market commentators are saying the returns on traditional asset classes will be low, if not strongly negative, over the next three to five years. Fixed-income returns are strongly linked to interest rates, and with rates already very low, it is hard to squeeze out additional return from rates falling. We have been squeezing the juice out of that orange for more than 30 years after peaking in 1982 at nearly 15%. The most recent close as of this writing was a mere 1.61%.

Data by YCharts

Data by YCharts

Of course, we could be heading to negative rates like Europe and Japan have been experiencing for a number of years, but that is unlikely given the negative ramifications of such a policy. But will the market drive longer-term rates down to zero? Lacy Hunt of Hoisington Asset Management has been espousing such a view for some time now.

In his most recent missive, he writes:

Five considerations indicate that inflation, real growth and interest rates will be less in 2020 than in 2019. First, momentum is to the downside since 2019 economic growth was fading as the domestic and global economy prepared to enter the new year. Second, U.S. monetary conditions are still restrictive. Third, the domestic and worldwide debt overhang became even greater in 2019. Fourth, average U.S. economy-wide profits have been flat since 2012. Fifth, excess manufacturing capacity is greater than a year ago, indicating that firms do not having pricing power.

...

These five factors - loss of momentum, monetary restraint, high debt levels, flat profits and excess capacity - will bring about slower growth and continue to subdue core inflation in 2020. Over the past 65 years, yields on long dated risk-free U.S. treasury securities moved in the same direction as core inflation on an annual basis roughly 80% of the time. We believe that there is a high probability that this relationship will hold in 2020 as inflationary pressures continue to subside.

In other words, according to Hunt, it makes sense to not worry too much about rising interest rates.

The Hunt For Yield Is On

In this low rate environment, investors have been again hunting for any yield they can find. As we explore in our February monthly letter to members, we are seeing a shifting of fund flows back into equities. Most of this is flowing into areas of the market that are already rich but offer some income, like REITs, utilities, and other dividend payers.

I've read a lot of pundits advising investors to shorten durations to hedge against interest rates rising as well as increase quality because spreads are tight. This sounds good in theory to reduce risk, but what they do not mention is that the moves result in low yields, and possibly missed opportunities.

If we are not entering a recession in 2020, why do we want to sell out of high yield and long-dated bonds now? For one, I chuckle since the two moves are almost oxymorons. If you increase quality, you are hedging against a downturn. If a downturn were to materialize, interest rates would likely decline and result in long-dated bonds increasing in value. So, why would you want to shorten durations?

In our view, there is no reason to avoid high yield at the moment even if spreads are tight. That would be akin to selling out of stocks since they are at record highs.

How To Add Income Opportunities Without Significantly Adding Risk

With interest rates moving lower again so far in 2020, instead of selling out of long-dated assets, you can add other sectors to your portfolio. Rather than use a one-stop fund solution for your fixed income (like a "Total Bond Fund"), you can pick spots in the bond market and hybrid securities sectors.

One area where we think investors can look is lower-quality high yield debt. These bonds pay yields that are significant because the risk of default is higher. But they have significantly lagged both the rally in high-quality non-investment grade and the equity markets. I always find it funny when an investor shuns a CCC rated bond and then goes and buys stocks instead because the "better bonds" don't pay enough.

Emerging market debt looks very cheap still to generate a 5%+ yield. The dollar looks expensive here, as rates appear to be heading further lower, which may attract more capital to emerging markets.

But for those that do not want to venture into lower credit ratings or emerging markets, simply changing how you hold your bonds can help significantly. The easiest way to accomplish "yield improvement" is to improve the wrapper that holds your bonds. One area of the public securities market that provides far superior yields and that is often unheard of, ignored, or castigated out of ignorance is the closed-end fund ("CEF") space. However, even most financial advisors have never heard of them, let alone the do-it-yourself investor.

And the asset managers out there really don't want you to know about them. Why? Because many sponsors who issue and operate a CEF do so as a "mirror" of their open-end mutual fund. But they would much rather you purchase the open-end mutual fund, since it amounts to "new capital" under their umbrella, and thus, more fee revenue.

CEFs have advantages and disadvantages that must be assessed. Still, we believe the returns greatly outweigh the risks. But one must know how to navigate the space. That is why we focus primarily on CEFs at Yield Hunting - we have been using them for most of the last two decades. Others in our team have used them for more than three decades. The complexity of the space lends to knowing at least some basic knowledge before venturing in. The spate of corporate actions (tenders, rights offerings, mergers, at-the-money offerings, etc) in recent months takes experience.

Concluding Thoughts

CEFs could be the next big thing - and we think they will continue to garner new attention from investors who are income hunting. Cash flow investors are multiplying as tens of thousands of boomers retire by the day and come to the realization that they are overly reliant on erratic capital gains for their retirement "health".

The fixed-income market is increasingly harder to navigate after a strong 2019 of returns and lower rates. Most retirees or soon-to-be retirees have little understanding of how the future of fixed-income will affect their retirement portfolios and sustainability of their standards of living. Investors need to adapt to the new reality - a paradigm of a new era.

One such CEF that we think investors should keep an eye on is the Blackrock Credit Allocation Income Trust IV (BTZ). The fund is one we've owned at Yield Hunting for a long time (since inception), and one I have owned personally going back to when it was four different funds. The shares trade tight to the NAV compared to historical average, but the sponsor (Blackrock) recently instituted managed distribution policies that boosted the payouts by 25% on all of their taxable bond CEFs.

This is one of those things where experience can help educate you and make better decisions. Over the last several years, many fund sponsors have been moving towards these managed distribution policies to target a specific yield, whether earned or not. But unsuspecting retail investors tend to look at two things: yield and discount. The higher yield looks juicy and, like the Sirens in Greek mythology, lure naive investors to the funds, tightening the discounts.

But BTZ is also undergoing a tender offer. This is a corporate action where the sponsor buys back your shares at a premium to the current price (usually at or near NAV). We expect to get approximately 25% of our position sold at a 2% discount in the next month after having bought the shares at more than a 12% discount last year. A nice 10% capital gain on top of the ~7% yield plus NAV appreciation.

Be on the lookout for the post-tender hangover. This is often a good time to buy as investors that rushed in to take advantage of the "free money" get out and move on. Often, there can be good buying opportunities as the discount "overshoots" to the downside. Stay tuned.

Our Yield Hunting marketplace service is currently offering, for a limited time only, free trials and 20% off the introductory rate.

Our member community is fairly unique focused primarily on constructing portfolios geared towards income. The Core Income Portfolio currently yields over 8% comprised of closed-end funds. If you are interested in learning about closed-end funds and want guidance on generating income, check out our service today. We also have expert guidance on individual preferred stocks, ETFs, and mutual funds.

Check out our Five-Star member reviews.

Click here to learn more.

Disclosure: I am/we are long BTZ. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment