Why Happiness Is The Secret To Getting An Edge On Your Business Competitors

Organizations and sales professionals need an edge on their competition to flourish. Traditional sales training, which emphasizes prospecting, presentation, negotiation and closing skills, can benefit from important research on the topic of happiness. This research is championed in the relatively new field of positive psychology. Happiness is no longer merely a utopian notion with uncertain practical utility. I believe it is now poised to unleash a massive surge in the potential of sales professionals and provide a powerful edge to propel any organization to new heights. Full disclosure: I wrote a book on the topic of happiness and am intrigued by the subtle connections between human happiness and business, especially from a business development perspective.

Happiness As A Reliable Predictor Of Sales Success

One 1998 study showed that happy study participants used more "cooperative, integrative, and ultimately more successful bargaining strategies." A 2018 study (via HBR) showed that optimists are more likely than pessimists to experience better financial health. Thus, happy people are uniquely positioned to experience greater sales success. Martin E. Seligman, a prominent positive psychologist, reportedly discovered in older research that life insurance agents with a more optimistic attitude sold 88% more insurance than pessimistic agents. In his book Learned Optimism: How to Change Your Mind and Your Life, he also explored why some people experience distress after facing a setback, while certain individuals are resilient and bounce back from failure. Seligman suggests that the latter group possesses a common trait, namely interpreting adversity in a positive way — they have an optimistic "explanatory style" (paywall). For example, a positive interpretation of a setback could involve thoughts such as that a setback is not as bad as it might seem and that things will get better. A pessimistic "explanatory style" would involve believing that things are, in fact, pretty bad, and they will not change any time soon. Optimistic salespeople will likely go on to try again, while pessimistic ones may essentially stop trying.

Other Happiness Studies Relevant To Sales Success

Other research reinforces the importance of maximizing happiness in an effort to increase sales success. In many businesses, sales professionals experience close rates as low as 15%. Such a massive rejection rate demands that sales professional rebound quickly from failure or other inabilities to close. A 2018 study on medical and dental students found a high correlation between their happiness and resilience. The ability to bounce back faster from rejection gives sales professionals an advantage because they're able to get back up to bat quickly and convey positive emotions to subsequent prospects.

A 2010 study found that satisfied workers studied were more likely to be more productive. Therefore, satisfied salespeople in particular may be more likely to be efficient, persistent and accomplished in connection with their sales efforts. Inefficiency is a time-waster and deal-killer. The sheer passage of time can kill a prospective deal.

Another 2010 study found that happy people are more emotionally intelligent (registration required). They may, therefore, be better able to navigate emotional aspects of a customer's decision-making process. Every prospect is different, with their own emotional tone level, perspective and desired means of communication. A higher emotional intelligence level can give the sales professional an enhanced means of understanding where the prospect is coming from and allow them to empathize with the prospect to create a customer-needs analysis. They can also make communication more effective by adjusting their communication methods to best match the emotional tone of the prospect.

Practical Interventions To Increase the Happiness Of Sales Professionals

It behooves sales professionals to boost their happiness levels as quickly as possible to capture as much immediate sales success as is practicable. They should also pursue behaviors and thought processes that are intended to yield long-term, sustained happiness.

Positive psychologists Sonja Lyubomirsky and Matthew D. Della Porta outlined various practical interventions that can provide boosts of happiness. Sales professionals can apply them in several ways:

Perform random acts of kindness every day. While any act of kindness to another person will suffice, sales professionals might send along a gift to a prospect, invite them to a fun event or refer business to them.

Express gratitude. Write five things you are grateful for in your business in a "gratitude journal" once a week. Or, write and send a letter of gratitude to someone in your professional life. Sales professionals might consider writing a letter to an existing customer thanking that person for their business.

Process positive experiences. Write, talk or think privately about positive sales experiences for 15 minutes for three consecutive days. Sales professionals could write down or recount those times when they were successful in making sales and when customers thanked them for excellent service.

Embracing The Happiness Sales Edge

Sales professionals should embrace the happiness sales edge to gain an advantage over their competition. It is now possible to implement sales strategies armed with the benefits of positivity to energize sales efforts and exponentially increase the likelihood of success.

The secret to Sosandar’s success

For a fashion retailer that’s driven by former magazine publishers, Sosandar has shown impressive growth since its launch in September 2016.

After 10 years of working together at Look magazine, Ali Hall and Julie Lavington left their jobs as editor and publishing director respectively to establish the online womenswear retailer.

The joint chief executives didn’t waste time, either – they started working on the Sosandar website the day after they left Look in October 2015.

In its most recent update, which looked at the three months to December 31 2019, Sosandar recorded a revenue increase of 136 per cent thanks to an expanded product range and increased TV marketing.

The founders told Retail Gazette that this was thanks to “a successful trial in TV advertising which, combined with the already established channels of social, direct mail and PR, expanded Sosandar’s ability to attract more new customers”.

Hall and Lavington admitted to finding “a gap in the market” and took that as an opportunity to target women who had moved on from the likes of Asos, but weren’t quite ready for Bonmarche.

“There was no ecommerce brand targeting that market (30-plus). We knew it was prime time to launch an ageless, trend-led brand at affordable prices,” they said.

In the three months to December 31 2019, Sosandar recorded a revenue increase of 136%

In the three months to December 31 2019, Sosandar recorded a revenue increase of 136%

Suzanne Blake, global head of marketing at brand consultancy firm FutureBrand, attributed Sosandar’s success to its “deft understanding of its consumer base”, especially in today’s tough retail climate.

Understandably, Sosandar’s ability to identify its target market puts it on a pedestal, while its recognised rival and embattled retailer Marks & Spencer struggles to pinpoint its market.

M&S has often targeted an older age demographic in the past, but most recently it launched its exclusive Goodmove athleisure brand to attract a younger audience. Rita Harnett, ecommerce partner at media agency Wavemaker Global, suggested that M&S appears to have “lost its way with customers in this age group, while Sosandar has done a superb job of shaping its strategy around that audience”.

“The Per Una and Autograph customers of this world are looking for excitement and style ideas and M&S is not quite hitting the spot,” Harnett said.

“Sosandar has recognised the importance of influencers & celebrity endorsements”

“Sosandar has recognised the importance of influencers and celebrity endorsements, a mainstay of the M&S marketing strategy, showcasing products that have been worn by personalities that resonate with that age group, such as Amanda Holden and Susanna Reid.”

Ten years before Sosandar launched, fellow online fashion retailer Boohoo embarked on becoming one of the biggest online retailers, most recently recording sales of £473.7 million for the group.

Sosandar’s initiative to use a similar formula a Boohoo by targeting a niche and fashion-conscious market was arguably a risk, considering that the traditionally older demographic may not be as amenable to online fashion as millennials.

However, Sosandar’s successful Christmas trading went against expectations, reporting a ”substantial” growth in its active customer database, which now stands at 110,000, and that repeat orders in the period increased by 140 per cent.

So what has it done right?

According to Harnett, Sosandar arrived in the market at an opportune time.

“The 30-plus age group is undergoing a challenging time, with multiple high street retailers struggling to cope with the changing demands of customers,” she explained.

“Traditional retailers such as Debenhams and House of Fraser, where this age group would once have shopped, are going through turmoil.”

Besides this, Sosandar offers a “seamless customer experience” by creating an easy-to-navigate website – something crucial for an online retailer.

The product detail pages also list other products to “wear it with”, which can be added to the basket straight from the same page – offering convenience.

Nottingham Business School retail research associate Nelson Blackley said Sosandar’s founders have “a powerful combination of creativity and data understanding”, which has benefited them when embarking on their online fashion start-up.

He added that Sosandar’s debt-free status is “unusual” considering it’s a form of pureplay retail.

“It operated only from shareholder funding which means it must be responsible in the way it develops and grows organically,” Blackley told Retail Gazette.

“So cautious growth is required as future funding depends on share issues.

“However, it has used some of the £7 million raised from the sale of new shares last summer wisely to increase investment in relevant channels such as TV marketing campaigns, including digital ads in underground stations to increase brand awareness, customer retention and new customer acquisition.

“This also has built on its already established channels of social media, direct mail and PR.”

“The 30-plus age group is undergoing a challenging time”

Alex Smith, brand expert at design agency Basic Arts, said it’s expected that retailers such as M&S – who have traditionally seen the 30-plus range as their “territory” – may be threatened by Sosandar’s acceleration. But he suggested that these high street retailers “should have been prepared”.

He also said these retailers should now focus on their bricks-and-mortar space rather than work hard on their digital space.

“I don’t think the answer for such embattled high street brands is to work too hard to chase Sosandar into the digital space, because it’s unlikely they’ll ever be able to match the executional strength of a brand who are built for that environment from the ground up,” Smith said.

“Instead they should be focusing on their strengths in the bricks and mortar space – something that isn’t going to disappear – and offer a counterpoint to online fashion, doing things that Sosandar could never do.”

Sosandar’s brand campaigns have been running on social media platforms for a good couple of years, and its brand awareness strategy sets it apart from less successful competitors.

To drive this, Sosandar’s co-chief executives’ previous editorial experience was utilised to communicate with their audience, and tap into that authenticity and warmth via innovative social, direct mail and PR campaigns.

Nevertheless, Sosandar has layered on reasons for customers to remain loyal, such as broadening its range and a offering a competitive delivery pass offer comparable to the likes of Asos.

Perhaps the problem for the likes of M&S, Debenhams and House of Fraser is that nowadays they are attempting to appeal to all demographics – while Sosandar is clear on who its serving.

Click here to sign up to Retail Gazette‘s free daily email newsletter

The secret of Games Workshop’s success? A little strategy they call total global domination

In an era defined by online shopping and falling real incomes, the high street can seem like a morass of zombie companies, hauling their carcasses from one sales season to the next until someone puts them out of their misery. One honourable exception is Games Workshop, a company that makes its money by selling zombies instead, alongside wizards, space orcs and all other accessories for the dedicated fantasy gamer.

Had you invested £1,000 in the firm’s shares at the end of 2009, you would now be sitting on a pot of more than £25,000. The company is the best performing FTSE250 retailer of the past decade – and second best performer overall. So what’s going on in those dungeons? What lessons can this impressive operator teach the rest of the high street?

Founded in London in the mid-1970s by Ian Livingstone and Steve Jackson – who would later became famous for co-authoring the Fighting Fantasy choose-your-own-adventure books – Games Workshop evolved quickly in its first few years of existence. It went from manufacturing and distributing traditional board games to focusing on fantasy fare, above all Dungeons & Dragons, the cult role-playing game from America that would define the whole genre.

The company soon launched the White Dwarf magazine, which became a bible for fantasy gamers, and moved into manufacturing miniatures for wargaming under its Citadel Miniatures brand. It soon began to build its business around these miniatures and, to a lesser extent, the Warhammer tabletop fantasy game, which launched in 1983. By the mid-1980s, White Dwarf had stopped covering Dungeons & Dragons and other people’s games to solely concentrate on the Games Workshop universe.

Let battle commence

This narrow focus has essentially continued up to the present day. It is key to understanding the business. To investors and retail staff alike, the company has long referred to its strategy as “total global domination”. It barely acknowledges the existence of competing games or miniatures, perhaps with good reason; it has no real competitors who can match its vertical integration in the marketplace.

Most other wargames manufactures are just cottage industries with no presence on the high street: the next most successful achieves less than 2% of Games Workshop’s £257 million turnover. The company’s stores stock only its own products, though it is more than happy to sell them elsewhere: 47% of sales come from third-party retailers, while a further 19% are online.

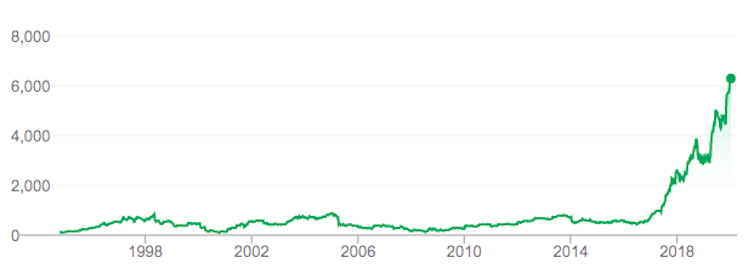

Games Workshop’s share price

Google Finance

Google Finance

Staff have regularly described the company as making the “best fantasy miniatures” in the world. Where most big Western retailers outsource manufacturing to contractors on the other side of the world, the firm makes almost everything at its own factory in Nottingham in the English Midlands, also the place of the company headquarters.

Games Workshop now has 500 stores worldwide – a fifth of them major outlets, while the rest are one-vendor operations like the one pictured below. Most of the bigger stores are in the UK, Europe and Australia, and total global domination has no room for passengers: loss-making stores are quickly reorganised to make a profit, or closed. There are also a smattering of stores in North America and Asia, though the company has never achieved critical mass in those markets like it has in the UK.

Our man in Strasbourg. Marc Buehler, CC BY

Our man in Strasbourg. Marc Buehler, CC BY

It is clear from my own research that stores function at least as much as clubhouses devoted to the hobby: collecting, painting and occasionally even gaming with the miniatures. Fans and customers obsess over both these figures and the complex fictional worlds in which the games are set.

Everything is built around two settings – one fantasy and one science fiction. You could legitimately accuse them of being derivative of the pop culture over the past half-century or so. But they function as fully realised, complex worlds complete with spin-off novels, comics, card games, computer games, and even a film – though Ultramarines: A Warhammer 40,000 Movie was hardly a classic. The logic is to give the dedicated fan so much to consume that there is no need, or indeed very much time, to bother with anything else.

One potential threat to this close relationship with customers in the past was the company’s approach to defending its intellectual property. Its legal department long had a reputation for zero tolerance, attracting heavy criticism, for example, for taking action to prevent an author from selling a book about space marines. My sense is that the company has become much less litigious since Kevin Rountree took over as CEO in 2015.

Treasure chest required

Buying into the Games Workshop hobby is not cheap, it should be said. You can easily pay over £50 for just a dozen plastic figures, for instance, plus another £25 for paints and brushes. This attracts regular gripes from both fans and the press, and is presumably integral to the company’s surging share price and mainly strong financial results.

Yet steep prices are only viable if the product is good enough. The company has regularly rebooted and reinvented its own games and worlds over the years, though arguably they can never be well enough tested to satisfy competitive gamers. The complexity of each game system and the need to bring out new versions to sell more models tends to mean that one strategy becomes too dominant.

The company has also innovated in other ways – recently, for example, formulating revolutionary new paints and painting techniques to make it easier for the customers to get great results with their figures.

Steady as she goes. BorisTheFrog, CC BY

Steady as she goes. BorisTheFrog, CC BY

Can the success story continue? There seems every reason to assume that it can. It might even benefit from the mounting concerns around the carbon emissions from video gaming, and the need to transition to low-carbon computing.

Though Games Workshop certainly makes money from branded video games, being anchored in physical products and stores that offer a communal experience could be a good place to be in years to come. So long as you can save your prized miniature collection from extreme weather events, Warhammer 40,000 and Age of Sigmar will continue to be playable in a post-carbon economy. For a company that has done so well out of dystopian fiction, that would arguably be a fitting turn of events.

No comments:

Post a Comment